The last few years have been very eventful in the world of pharma marketing. Unsurprisingly, 2020 has been the climax. In this article, we’ll explore some of the most important digital pharma trends and examine how they are affecting strategies.

Third-Party Cookie Support

Earlier this year, Google announced that it would be dropping support of third-party cookies in 2022.

The change is going to have repercussions for all digital marketers. For pharma marketers, this means that we won’t be able to target audiences by gender, browsing habits, and other inferred personal characteristics derived from browsing behavior.

The effects are too numerous to discuss in this article. If you’re interested in a more detailed discussion, we have an article on cookie-less digital pharma marketing.

Virtual Detailing

Surprisingly, HCPs are talking to sales reps more often than before the pandemic. What makes this a digital pharma trend is that these conversations are happening virtually.

This is unfamiliar ground for most sales reps.

As digital marketers, we can help them out by bringing personal and non-personal promotion closer together:

- “Talk to a representative on Zoom” calls-to-action. A Zoom CTA provides a smooth transition from the digital space to a more personal one. It is also a more end-to-end method of tying digital campaigns to HCP conversions.

Hosting monthly or quarterly Zoom webinars on HCP websites. These webinars would be easy to promote, boost SEO, and provide a list of emails for future contact.

- Optimizing campaigns based on successful calls. One can find out which keywords and placements are driving the most productive discussions and direct budgets more efficiently.

- Recording Zoom conversations for sales rep training (as long as permission is granted by the recorded parties).

- Creating simple apps to house interactive visual aids. HCPs will now have a reason to download interactive visual aid apps so that they can follow along with sales reps during calls. This act itself opens up many possibilities:

- Tracking how HCPs engage with the app.

- Sending push notifications to installer devices reminding HCPs about your brand.

- Featuring a copay savings card page in the app so that HCPs can email or text coupons to patients. One can then track claims and trace them to the app downloader for attribution and remarketing purposes.

Non-personal promotion strategies are most effective when multiple channels are interwoven. Virtual detailing makes it much easier for digital marketers to include personal promotion in a multichannel strategy.

This is a digital pharma trend that might stick with us after COVID.

87% of HCPs want virtual contact to remain or even completely replace in-person visits after the pandemic. It’s an exciting digital pharma trend that appears to be here to stay.

Telemedicine

Telemedicine proliferation is another key digital pharma trend. Pharma brands must understand how telemedicine fits into their strategy because of this.

You’ve probably already considered a telemedicine partnership if your brand is prescribed by the below specialties:

- Radiology

- Psychiatry

- Internal Medicine

- Neurology

- Family Medicine / Pediatrics

- Dermatology

- Emergency Medicine

- Geriatrics

- Allergy & Immunology

- Infectious Disease

- Endocrinology

- Urology

- Occupational Medicine

- Pediatric Pulmonology

Brands partnering with telemedicine providers can turn patient interest into appointments on a pay-per-click basis. This is a much tighter strategy than driving patients from a digital space to a non-digital space (the office) because the time lag to conversion is much lower.

Telemedicine proliferation is a game-changing digital pharma trend. Depending on your target audience, it can be great asset or a big hole in your strategy.

Mature Data Use

In the 2010s, healthcare organizations collected a lot of data. But as pharma marketers, we struggled to take full advantage of data and its mutability.

Now, we are using data in some really cool ways.

Consider the following campaigns. They’re both award-winners that highlight this digital pharma trend.

The Rape Tax

The ‘Rape Tax’ campaign turned data from a targeting component into part of the ad creative itself.

The National Organization for Victim Assistance (NOVA) aimed to confront rape victims’ reticence to report the crime and seek treatment. From market research, their advertising team learned that the average medical bill of a rape victim is $1,000.

The Area 23 decided to tell each rape story as a medical bill. Rape victims visited RapeTax.com and entered their medical bills into a web form. The team then used the medical bills as advertising creative for digital billboards, print advertisements, and other tactics.

The strategy drove a 60% increase in call volume and a 40% increase in website traffic.

The campaign showed that data is what you make of it. Data on a server is meaningless without context. ‘The Rape Tax’ demonstrated fantastically that even form submission data can produce a visceral reaction in the right context.

GSK’s Shingrix® Campaign

GSK’s Shingrix® campaign is another great example of this digital pharma trend. It by far the most sophisticated approach to HCP messaging that I have come across.

The company purchased third-party data on HCPs from CMI/Compas. Then, they paired this data with website user recognition-technology offered by DMD Healthcare.

Using a combination of analytics, third party tracking software, and first-party marketing automation, the Shingrix® marketing team re-engaged website visitors with emails that built off of the HCPs website visit.

The campaign succeeded. It generated more than two website visits from 66% of engaged HCPs. It also won a Gold award from MM&M.

You can read our article on the subject if you are interested in hearing about the technology behind the campaign.

Looking to the Future

These examples are the best of the best. But the middle of the pack has advanced as well.

Ten years ago, we were still coming to terms with the principles of PPC marketing. Now, we’re tying in savings card ID claims and using complex attribution modeling.

Mature data use also goes hand-in-hand with our digital pharma trend: artificial intelligence.

Artificial Intelligence

Artificial intelligence is a hot digital pharma trend.

Next-best Action Analysis

In next-best action analysis, marketing teams mine historical data on audience engagements in order to inform future marketing actions. If enough people react positively, one can find similarities in their experiences and try to duplicate the experience with future audiences.

In a process like this, AI is unmatched in its speed and accuracy.

Morgan Stanley is benefitting greatly from its AI-based NBA platform that it implemented during COVID. Pharma marketers are also looking for ways to make this jump. HCP outreach has a similar approach to financial management marketing with respect to approaching and up-selling individuals.

Soon, tools like Acoustic will tell us how to generate more HCP engagement on an individual level.

Chatbots

Pharma marketers haven’t exactly raced to deploy chatbots. There are success stories though.

For example, The Unblush Symptom Checker is a simple chatbot dressed up as a web form. The bot collects answers for lifestyle and health status questions and determines if she should be routed to a telemedicine provider. The bot tripled branded conversions.

More complex symptom checker bots are in the space as well.

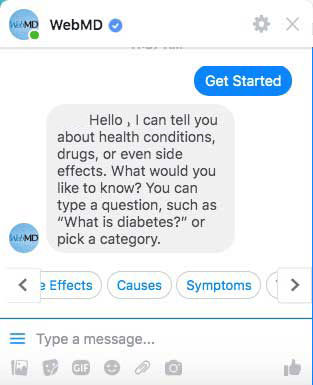

Consider WebMD’s bot on Facebook, which automatically replies to messages.

After the user types ‘Get started’ in the dialogue box, the chatbot provides a list of queries for which responses are available.

The user types in a query that the bot has listed in order to move the conversation forward

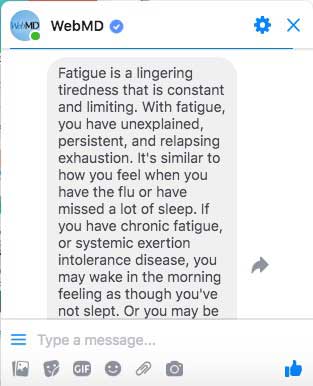

The chatbot’s response to the user entering ‘Fatigue’ is general but does call out possible illnesses that can cause excess fatigue. Eventually, a link is provided to a more in-depth page with resources

If thoughtfully deployed, a similar pharma chatbot would drive leads on a large scale. The primary hurdle is medical legal review (which, admittedly, is a big hurdle).

Teams that put in the work have been rewarded. Because of this, I think chatbots will escalate from ‘digital pharma trend’ to ‘DTC staple’ in the future.

Improving Electronic Health Records

Across specialties, physicians spend 3-6 hours per day on EHRs. Much of this time is spent entering data or struggling to find data. Even copy and paste functionality is still an issue.

Previously, EHR adoption was the primary trend. Now, improving them is the focus. And AI is playing a big role.

- Cerner has rolled out new AI functionality in each of the last two years1,2. The platform now uses AI to assist in coding, documentation, transcribing, and other basic tasks.

- Epic has also rolled out AI in its EHR. The platform uses AI to assess patient risk levels and mortality. It now has natural language processing that can assist in completing basic data entry.

- Google is also working on an EHR. One can assume that robust AI will be a part of it, as Google and other tech companies are developing AI that is capable in assisting with clinical decisions.

These changes could significantly increase HCP efficiency when performing daily tasks. This means that they will be able to:

- See more patients.

- Spend more time learning about treatments and staying current with medical news.

However, the most important effect of improved EHRs may be that HCPs won’t visit pharma sites as often.

- According to Jason Bernstein’s webinar, “The Disconnect in Digital Engagement”, 91% of HCPs have to consult exterior resources to find information when viewing an EHR.

- Most of the time, they were looking for simple drug information like ISI and dosing info.

Soon, pharma marketers won’t have to spend their PPC budgets making up for EHR shortcomings. This will be a blessing and a curse.

- We’ll save money buying high-decile prescriber clicks.

- We’ll have fewer chances to reach low-decile prescribers.

It’s a digital pharma trend that could have big implications in the early part of the 2020s.

Subcribe to the bfw Life Sciences Advertising Blog!

We hope that this article provided a little more detail about the digital pharma trends that are being discussed. Subscribe to our blog to receive email updates on new life sciences advertising content!

That’s all for now!

Hosting monthly or quarterly Zoom webinars on HCP websites. These webinars would be easy to promote, boost SEO, and provide a list of emails for future contact.

Hosting monthly or quarterly Zoom webinars on HCP websites. These webinars would be easy to promote, boost SEO, and provide a list of emails for future contact.